Blockchain has made our world more democratic. Today it is easier than ever before to raise money for your project and get the necessary funding for your startup.

Up to 3 years ago, angel investors and VCs had the monopoly of money, and hence they effectively controlled whose idea could be given a try. This has changed drastically.

Blockchain has made our world more democratic. Today it is easier than ever before to raise money for your project and get the necessary funding for your startup.

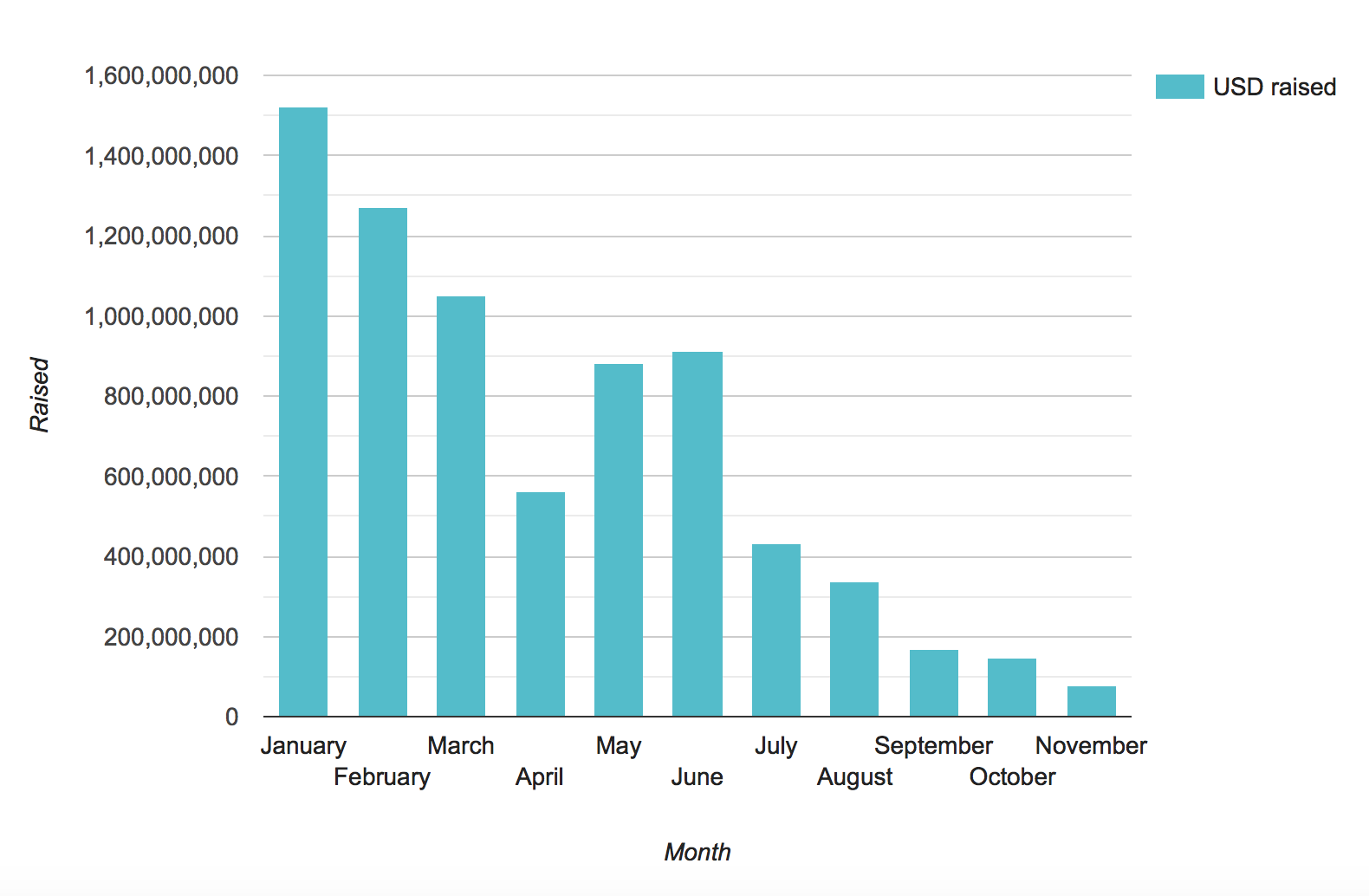

With the birth of cryptocurrency and wider spread of the blockchain technology, a new form of fundraising (or alternatively – crowdfunding) was born – the Initial Coin Offering(ICO). To this day, the money raised through ICOs (in just over 3 years’ time) has totaled over $13,500,000,000, with over half of the total amount being raised in 2018 alone.

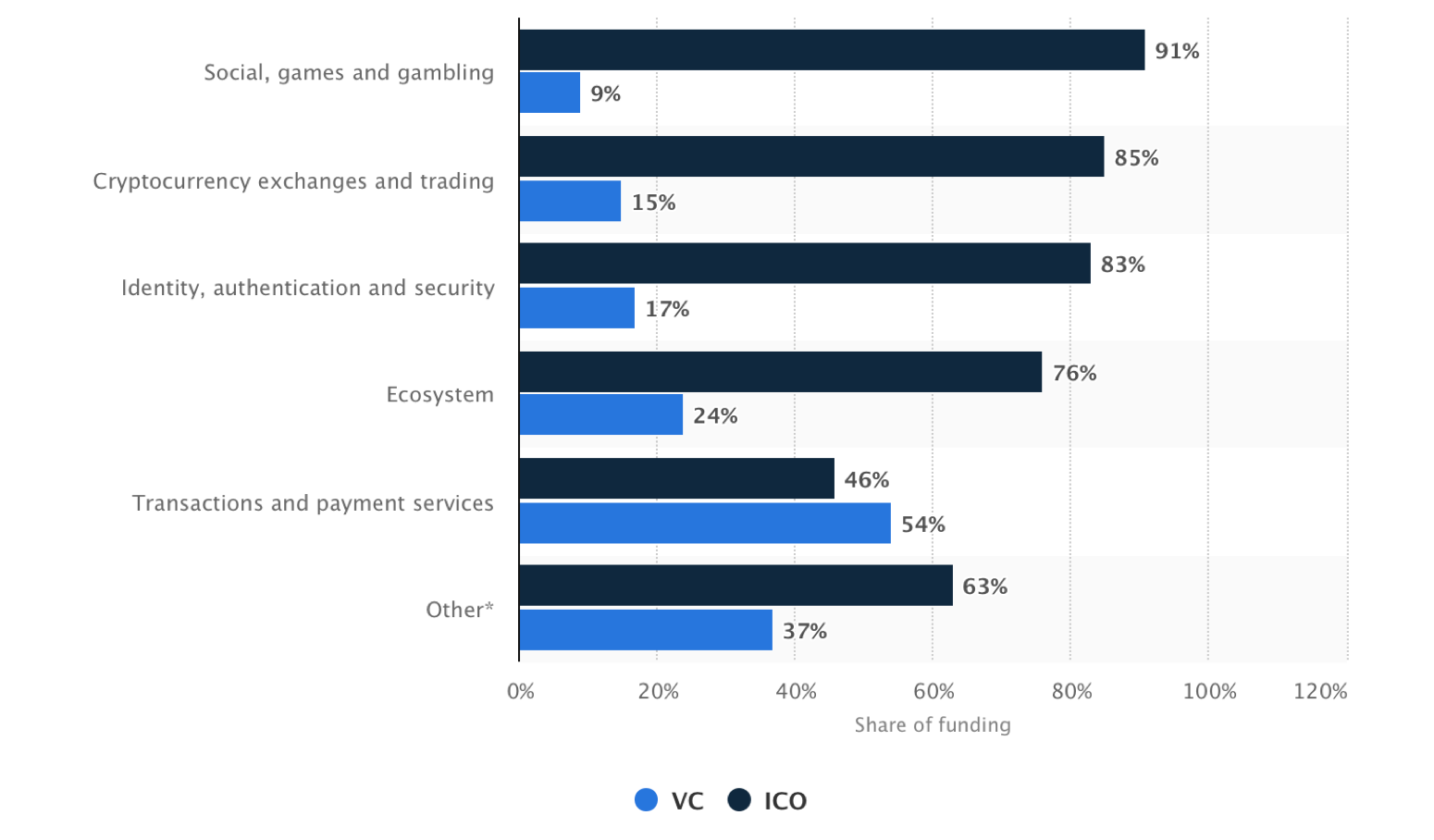

This graph below brilliantly captures the change we are seeing nowadays. See below the distribution of Initial Coin Offering and Venture Capital funding worldwide as of April 2018, by sector (in million $, Statista):

It is important to note that in nearly each and every sector ICO funding was higher or significantly higher than the VC funding. Obviously, the data provided above is not the most up to date, and this has shifted away quite a bit. Yet, it pretty well illustrates that times are changing.

As does times, the cryptocurrency & ICO market has changed as well. Because of many scams, unreasonable expectations, lesser hype and lost optimism, the markets have crashed taking ICOs with them. The graph below is a perfect illustration of this phenomenon (funds raised via ICOs in 2018):

Seeing this and taking other factors into consideration (such as little utility & value, little to no accountability, non-compliance to regulations etc.), many now are claiming that 'ICOs are dead', and the future belongs to STOs.

Is it? What it actually means, and is it substantially any different? If you are curious about it as much as I am, continue reading because here is everything you need to know about the Security Token Offering, or STO.

What is an ICO?

In order to get the most out of this read, let us begin from the beginning and define what is that magic word called Initial Coin Offering (ICO).

Simply speaking, an ICO is a way of raising funds when the coins being sold are similar to Bitcoin and Ether. Investors purchase a coin, or digital token, that they can use further in the future to buy a product or service a company plans to offer. We must note that due to the fact that BTC and ETH were usually used by the investors to purchase coins during the ICOs, this has fuelled a sharp rise in these virtual currencies back in 2017 and early 2018 (for more, read my earlier article ICO – the New (and Better?) IPO).

Usually ICOs issue utility tokens that allow owners to exchange them for future products or services produced by the company.

Usually ICOs issue a utility token which effectively means it does not generate equity or any other kind of asset from the company. These types of tokens could be described as an IOU* or a coupon which permits owners to exchange them for future products or services produced by the company.

Issues with ICOs

One of the key issues with ICOs was and still is the lack of actual utility and value. In other words, apart from speculation and possible increase in token value due to greed, hype etc., there's no point in holding the token since simply speaking it makes no practical sense.

The thing is that the whole ICO craze was primarily built on the theory that there will always be someone dumber than you and they will buy your tokens for more than you paid. And that’s a pretty good bet!... until it isn’t.

The whole ICO craze was primarily built on the theory that there will always be someone dumber than you and they will buy your tokens for more than you paid.

Another problem is that retail investors are usually the last people to invest with the least amount of information about the project (usually it’s just a whitepaper full of fancy words and unreasonable aspirations) and the highest amount of token price. Due to lack of transparency, they are often unaware of the token purchase price of seed investors, VCs or family funds. Once the token is listed on the exchange, the big guys can easily dump them making an easy buck while leaving individual investors with worthless digital coins.

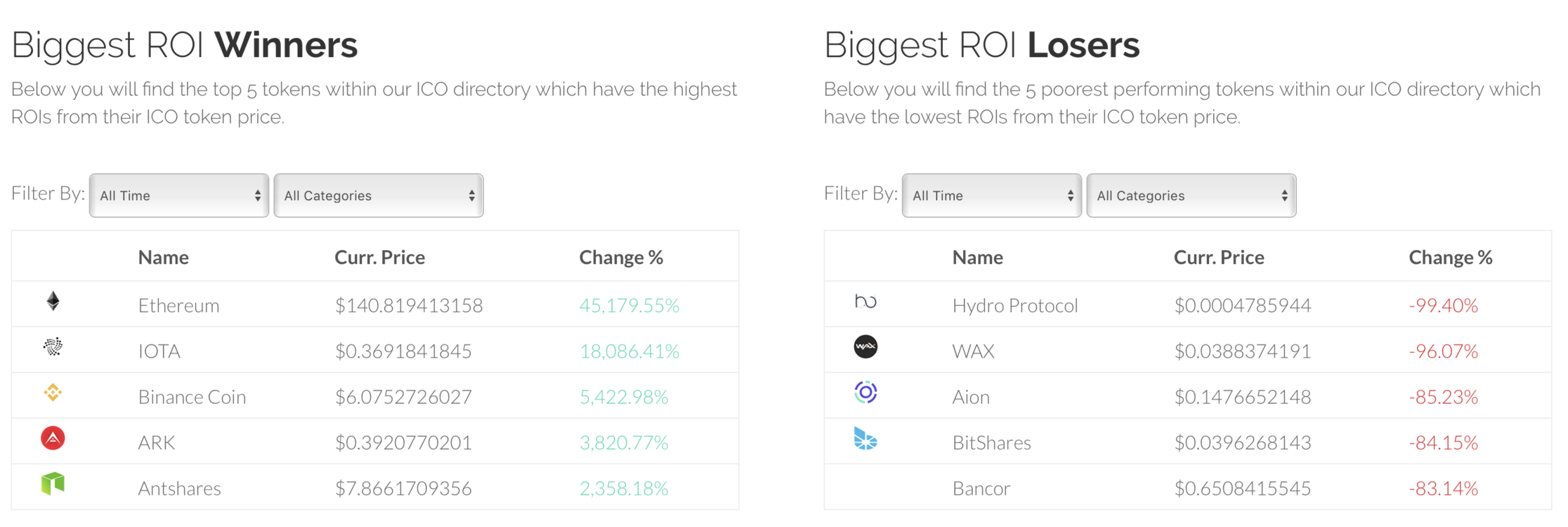

The data below (source: coinist.io) brilliantly illustrates how differs the ROI on various ICOs:

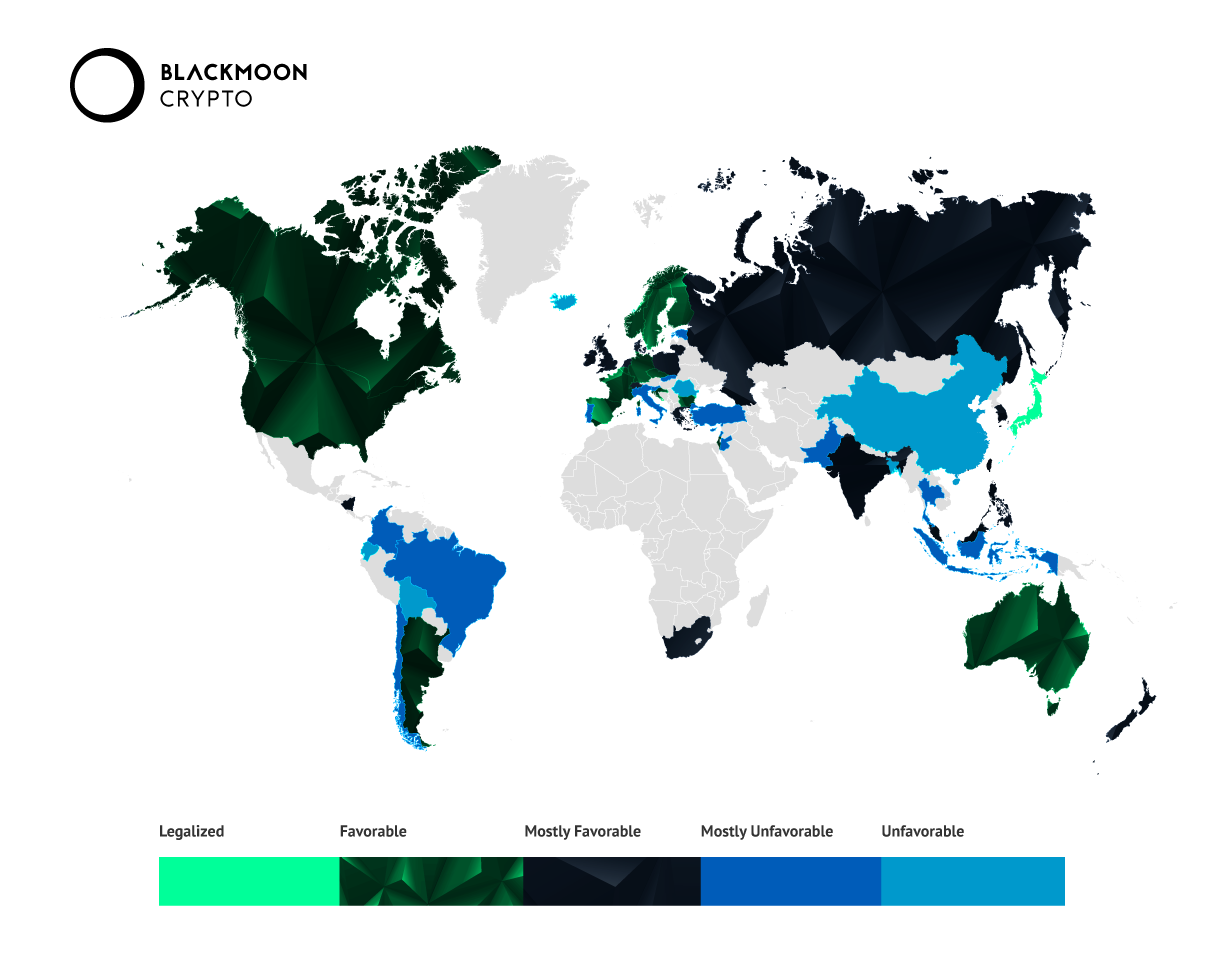

Finally, there’s a regulatory and compliance challenge. In most of the cases, utility tokens are operating on a fundamentally shaky legal ground. Though regulation differs on a country by country basis (see the graph below for visual understanding; source: Blackmoon Crypto**), generally many of the coins can be classified as securities, therefore, the regulatory aim is similar to that of Initial Public Offerings (IPOs).

As a concluding note, it’s important to stress that utility can’t be guaranteed by any company. If regulators determine that a utility coin is acting like a security — regardless of how the coin’s creators wanted the coin to be used — they can impose fines and regulations.

What is an STO?

STO, as previously stated, stands for Security Token Offering. Simply speaking, security tokens, or tokenised securities, can be defined as asset-backed tokens and they can be considered legally binding investment contracts that effectively give investors access to a share of the company, a monthly dividend or a voice in the business decision-making process.

Where STOs Add Value

ICOs were a very good and positive thing for all of us - they brought in the necessary funding for the future development of cryptocurrency and the whole blockchain ecosystem. Yet, it was nearly everywhere operating in the grey area with lots of uncertainty, and I have been arguing for quite a while that regulation is necessary here: it’s not the enemy of the good. Rather it would bring more stability into the market and open it up to more players.

This is exactly the background where STO are coming from, and it is one of their key advantages that is often being brought forward by their proponents.

STO simply speaking is an investment in equity, or in other worlds – in real assets. The buyer owns a percentage of whatever asset the token is tied up to, whether that’s company growth, real estate investments, some other asset(s) etc. This is the exact opposite of the ICO utility tokens, which have no real-world backing. Because of this, ICOs only hold value if the token’s value continues to climb.

STOs are investments in equity or real assets, and hence they are the exact opposite of ICO utility tokens, which have no real-world backing.

The word security is here for a reason: being backed by tangible assets means better assurance for investors that their coin will not lose total value overnight. STOs can build regulatory checks into their protocols, such as the Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Having rights already written into a smart contract with tokens traded on a blockchain exchange helps investors avoid many of the regulatory issues ICOs are now facing.

Because STOs represent clear investments, they are regulated, and must be registered with the SEC (U.S. Securities and Exchange Commission) or other respective regulator.

Why the Hype?

As noted earlier, there are firm believers that STOs are the next big thing in crypto & blockchain. Are they?

Well, one could claim that STOs are the greatest innovation in the world of securities, since securities were the greatest innovation in finance (back in 13th century Venice).

The combination of conventional regulatory framework for securities with the core efficiencies of blockchain brings securities market with bigger liquidity, lower costs, fractionalisation of larger assets and bigger market efficiency. Hence, it’s not surprising at all that many companies and institutions are now actively developing infrastructures for issuing security tokens, some with a goal of creating more inclusivity for enterprises which have not typically been able to raise capital.

Tokenisation of securities brings securities market with bigger liquidity, lower costs, fractionalisation of larger assets and bigger market efficiency.

Tokenising securities means cutting costs for issuers, but also increasing efficiency for automated traders and intelligent trading assistants. It also promises removing the middlemen, executing deals faster and automating various task that are now mundane and cost-inefficient.

Hence, it’s not unrealistic that someday STOs might experience the same kind of growth that occurred for the token sales in 2017 and early 2018. One has to note that ICOs were and still are only a very small fraction of the incumbent financial markets.

For better understanding of the potential of Security Token Offerings, think of real estate, which alone has over $1 trillion in financial assets and whose ownership could be managed using Security Tokens.

Generally speaking, nearly every industry has a use for tokenized securities, whether to finance new ventures or manage ownership of existing ones; or, they can be used to test entirely new business models. The public sector might one day use security tokens as well - to issue state, provincial, or federal municipal bonds; central banks could tokenize their national debt offerings too.

Regulation

So you found the above beyond exciting and you cannot wait when you can issue your security tokens. I wish you all the best, and to make your life easier, let me give you a review of regulations you most probably will have to adhere to.

In the US, security tokens need to follow these regulations:

Regulation D

Regulation A+

Regulation S

Let us quickly go over each every one of them.

Regulation D

Regulation D will permit a particular offering to avoid being registered by the SEC given the “Form D” has been filled by the creators after the securities have been sold. The person who is offering this security may solicit offerings from investors in compliance with Section 506C, which requires a confirmation that the investors are indeed accredited and the information which has been provided during the solicitation is free from false or misleading statements.

Regulation A+

This exemption will allow the creator to offer SEC-approved security to non-accredited investors through a general solicitation for up to $50 million in investment.

In order for the requirement to register the security, the issuance of Regulation A+ can take a lot more time compared to other options. For the same reason, Regulation A+ issuance will be more expensive than any other option.

Regulation S

This is when a security offering is completed in a country other than the US and is therefore not subjected to the registration requirement under section 5 of the 1993 Act. The respective creators are still required to follow the security regulations of the country where they are supposed to be executed.

The Downside

Obviously, Security Token Offerings (STOs) are not only ponies and rainbows, and cannot solve all the problems in the world. There certainly are potential shortcomings and inherent risks, and let us try to take a look at some of them.

Paying out Dividends

One of the benefits of STOs is that dividend payments are hard-coded into the token itself, assuring fair payments for the token holder. Yet, dividends based on earnings are highly subjective.

The only way to hard code dividends is to have them based off the company’s gross revenue. This cream off the top method of income distribution is most easily done when companies transact in cryptocurrencies — such as their own tokens — or in main cryptos like Bitcoin, Ether and Litecoin because portions of each transaction can be automatically credited to investor accounts using a simple algorithm. This certainly guarantees a dividend paid to investors, but does not work in the best interests of all startups.

Taxes

STOs are tax-inefficient as the income from dividends is subject to double taxation: first at the corporate level and a second time at the individual level.

Security Risks

The truth is that many companies in the blockchain space cut corners when it comes to securing smart contracts. With the shortage of experienced developers, it is only too easy to replicate code bugs, and without a third-party process of auditing smart contracts they are often only discovered after being hacked. As the industry moves forward and develops, this risk will only grow.

Also, the hunger for raising capital pushes offerings fast rather than doing things correctly. Thus, it is not a matter of IF but WHEN the first STO gets hacked.

Bringing it all together

To put it in a nutshell, Security Token Offerings are both interesting and really promising formation that embodies the next phase of the Crypto/Blockchain Revolution.

If all the promises are met, STOs might truly become the biggest innovation in the world of securities. Yet, it is up to us and the bold leadership that will be willing to take the risks, challenge themselves and pave the way towards a more efficient, transparent and open financial world.

If technology and regulation manages to find a brilliant synergy - the future is more than bright. Can you see it too?

*An IOU is an informal document that acknowledges a debt owed, and this debt does not necessarily carry a monetary value as it can also include physical products. The informal nature of an IOU means there may be some uncertainty about whether it is a binding contract, and the legal remedies available to the lender may be different from those involving formal contracts such as a promissory note or bond indenture. Because of this uncertainty, an IOU is normally not a negotiable instrument during litigation or negotiations (Investopedia).

**Information in the graph is not up-to-date and was used for illustrative purposes only.

P.S. You might enjoy my earlier pieces as well:

👉 Forget Bitcoin - Cannabis is the New Crypto

👉 Crypto is NOT a Bubble. Never was, and hardly ever will be

👉 Investors won't see Bitcoin ETFs any time soon. Here's why

👉 All you need to know about Bitcoin ETFs now

👉 FinTech Predictions for 2018

👉 Blockchain Predictions for 2018

👉 Bitcoin is NOT a Currency, and Never Will Be

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at one of the leading alternative banking and payments providers in EEA, I'm an active member of FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment what you think and share the article with others. Let's spread the knowledge together!

https://www.linkedin.com/pulse/all-you-need-know-stos-linas-beli%C5%ABnas/